Believe it or not, you don’t have to be rich to travel well and travel often. With a bit of careful planning, it’s possible to have amazing adventures without winning the lottery or selling your soul.

But even the most budget-friendly trip requires some cash upfront. This article is all about how to save up for travel, even on a modest income.

Before I started traveling, I was a classroom teacher. I dreamed of doing a long jaunt around the world, so I started saving money about a year before I hoped to leave.

During that time, I saw tons of other bloggers publishing articles like “How I saved $100,000 for travel in three months while fostering twelve puppies and winning an Olympic medal.”

While that’s amazing for them and totally #goals, those numbers aren’t realistic for everyone.

They certainly weren’t realistic for me.

Instead, I made simple, smaller changes that helped me amass a nice little travel fund over time. As you read, don’t get too hung up on the specific things I cut back on. Those will look different for everyone. You’ll need to decide what you can and can’t live without based on your priorities.

The important thing is to get started, so let’s do this!

How To Save Money For Travel In 10 Steps

Below I’ll walk you through the 10 simple things I did to save money for travel. Not every option will work for every person, which is totally okay. There are so many great ways to save up for travel and this is just the tip of the iceberg.

Fancy Legal Disclaimer: I’m definitely not a financial advisor or any kind of financial professional in any way. I’m just telling you things I did to save up for travel and my personal experiences. This is not professional, financial, legal, or any kind of other advice and shouldn’t be taken as such. But I’m sure you already knew that.

I opened a travel savings account.

First, I set up a separate account for just my travel savings. Having my travel fund separate from my checking account and general savings account was critical because it constantly reminded me of that money’s purpose.

If it was just lumped into my regular accounts, it would have been way easier to accidentally spend it at Chipotle or Target. But by keeping the money earmarked for travel in a separate place, I was always reminded of my goal.

Whenever I cut back on an expense, I put the money I saved into my special travel savings account. Watching the number grow felt exciting and motivating.

I automatically transferred $25 into my travel savings account every month.

I started by transferring $25 a month from my checking account to my travel savings account.

Even though it was a small amount, this got the ball rolling with my travel fund. It was nice knowing that even if I did nothing else to save all month, I was at least contributing something to my goal.

Savings = $25/month, $300/year

I cooked meals at home and shopped in bulk.

I’ve had a lot of phases in my life. There was the horse phase, the croc-wearing phase, and the I’m-gonna-grow-zucchini-in-my-backyard phase.

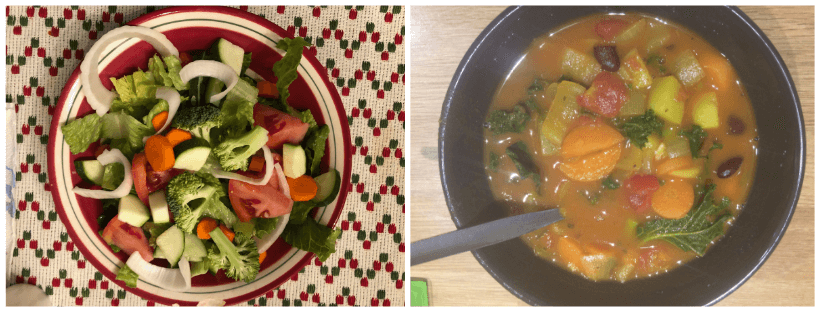

While I was saving for traveling, I entered my “cooking in bulk, but for one” phase.

The idea is that you dress up the same basic foods and have slightly different meals without buying a ton of extra ingredients.

For example, on Sunday I’d whip up a big batch of rice, beans, and vegetables. One day, I’d wrap the beans, rice, and vegetables in a tortilla with a dollop of salsa and a fistful of shredded cheese. The next night, I’d travel add a spoonful of hummus to my rice, beans, and veggies. Another night, I’d use the tortillas and cheese from night one to make totally new, exciting quesadillas. Voila!

Eating this way cut my weekly grocery bill from around $300 per month to $220 per month for one person.

Savings = $80/month, $960/year

I clipped coupons used cash-back apps for grocery shopping.

I didn’t go crazy with couponing the way they do in TV shows but it’s pretty easy to get a few good deals if you know where to look. Most popular grocery store chains have an app where you can find in-house coupons before you go shopping.

Kroger, a popular grocery store where I’m from, has an app that allows you to select the coupons you want to use and add them to your membership card. When you check out, you just swipe your card and the coupons are automatically applied.

I also used a cash-back app called Ibotta. Ibotta is awesome for getting money back on grocery purchases. They often have coupons like “$0.50 off milk, any brand” which are super helpful if you shop generic.

Here’s how Ibotta works:

- Download the app and select your grocery store.

- Go through the coupons and find which rebates you want before you go shopping.

- Make your purchases like normal

- When you get home, use the app to scan your receipt and scan the bar code of the product you bought.

- Once the app verifies your purchases, you’ll get the value of the coupon back.

The only downside of Ibotta is that you can’t cash out until you reach a minimum threshold of $20. Since I was meal planning and buying fewer groceries, it usually took me a few months before I earned enough to cash out.

Savings = $5/month, $60/year

I didn’t buy new clothes.

I’ve never been a huge fashionista but I have splurged on clothes in the past. For a while, I lived in a small town without much to do so it was common for me to spend my Saturdays getting wild in the TJ Maxx.

But when I decided to travel, I knew I wouldn’t be able to take much with me anyway. I didn’t want to buy a ton of clothes just to leave them behind in a closet so I avoided new clothing purchases as much as possible that year.

Savings = $30/every other month, $180/year

I bought books on BookBub.

Books are my Achilles heel. Books are such a wonderful wholesome thing to spend money on, right?

Well, when I started being strategic about saving money for travel, I realized that my book habit was pretty expensive, even after I made the transition to Kindle books.

Enter BookBub.

BookBub is a website that gathers e-book deals and special offers for a limited time. You can get tons of best sellers for free or just a few bucks. I rarely pay full price for books since discovering BookBub and it feels so good.

Savings = $5/month, $60/year

I canceled my gym membership.

I loved my little gym, but I wasn’t using it as much as I should have been. As things got busier with my teaching job, I was only going once a week. Truthfully, sometimes I only went so I could watch Property Brothers while slowly pedaling the stationary bike. It didn’t make sense to keep paying the membership fee.

Instead, I ran outside and got really into workout videos on YouTube.

Savings = $30/month, $360/year

I got a flexible side job teaching English online.

Before leaving for my trip, I started teaching English online as a way to save up some extra money. I loved it so much I never stopped!

Online teaching is a fully remote side hustle that you can do from anywhere. Since you get to make your schedule and there are no minimum or maximum hours, you can easily do it alongside your normal job to save even more.

On average, most online teaching jobs pay between $10 – $25 USD per hour.

If teaching English online isn’t your style, there are plenty more side jobs that can help you reach your savings goals. Here are a few ideas to get you started, but the online job possibilities are endless.

- VIPKID – Teach English Online (BA required)

- Cambly – Teach English Online (no BA required)

- iTalki – Teach ANY language online

- Virtual Assistant – Help businesses with bookkeeping, marketing, and other tasks

- Care.com – Babysitting and home care jobs

- Wag – Dog walking services

- User Testing – Test out websites and take surveys

Savings = $160/month, $1,920/year

I opened a credit card with travel perks.

At some point during my trip planning, a friend who is credit-card savvy recommended I sign up for a card with travel perks. I would have no foreign transaction fee and get double points back for any travel-related purchases.

When I enrolled, the card company was offering a huge sign-up bonus of $500 or 50,000 points. Those points could be redeemed for travel at 1.25x their value. By opening the card and meeting the requirements, I got $625 worth of points to be used on flights and hotels.

Now, I’m not recommending that you just go opening credit cards willy-nilly. Do plenty of research to decide if credit cards are right for you and which one suits your needs. But keep an eye out for cards with travel perks if you hope to hit the open road one day.

Because they’re travel points and not cash in my account, I didn’t add this $625 to the savings total in this post. Still, they definitely came in handy when I booked my first flight for free.

Savings = $625 in travel points

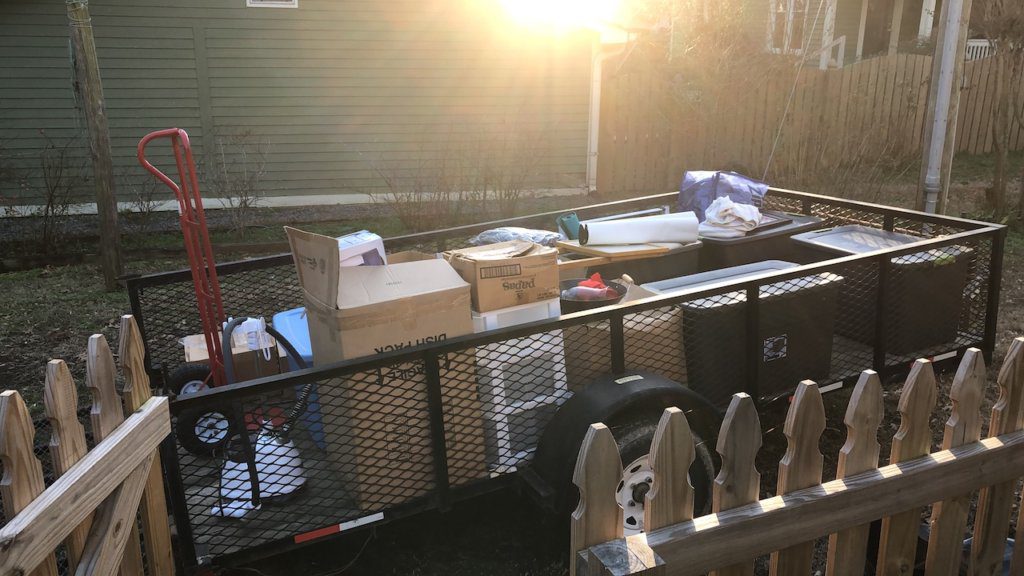

I got rid of my storage unit.

Getting rid of my storage unit is the number one biggest thing I wish I would have done sooner.

I had my storage unit for years before I finally sat down and added up how much that thing was costing me. When I ran the numbers, I was shocked and a little embarrassed by how much I was paying just to keep things I hadn’t used in years.

It was time to empty the beast.

Cleaning out the storage unit was a massive undertaking. It turned out to be much harder than I anticipated because I had accumulated a lot of stuff.

I went through everything Marie Kondo style. First, the clothes. I gathered every piece of clothing I own and dumped it all on my bed. Then, I went through it piece by piece. That alone took four full days.

Most clothing got donated. The things I decided to keep were neatly folded into containers and stored in the attic.

Next, I went through the furniture. My dad helped me list the furniture that was still in good condition on Craigslist and Facebook Marketplace. I priced everything low and pieces sold quickly. The things that didn’t sell in a week were donated.

Any money I made from the sale of furniture went right into my travel fund.

Since I didn’t do this before I started traveling, I’m not adding it into the final total. But boy, do I wish I had done it sooner.

Savings = $80/month. Had I done it sooner, I would have saved an additional $960/year

What I did well

After a year of actively saving money for travel, I left for my adventure abroad with $3840 in my travel savings account. I also had $625 in travel points that could be used on flights and hotels. Couple that with free accommodation through house sitting and I was in good shape!

Keeping my travel savings fund in a separate account helped me stay motivated. Seeing the tangible balance I had accumulated toward my goal made it easier to forgo little temptations like stationary, baked goods, and books about lizards.

Starting early was one of the best things I did for myself. I didn’t have a solid idea of where or how I was going to travel, but I knew it was a priority. So I started saving even when I didn’t quite know what I was saving for, which ultimately took a lot of the pressure off along the way.

Some months I did better than others. At times over those two years, I had more than $3840 in my Travel Savings Account. I took trips domestically with friends that cut into my bottom line, but looking back I’m happy I did that. The money was intended for travel and I used it for travel, just on smaller trips that prepared me for my bigger one to come later.

What I would do differently

If I could do it all again, I would have gotten rid of the storage unit sooner. There was really no reason to keep it as long as I did.

I also wish I had started teaching online sooner. I could have easily picked up some classes in addition to my regular job. If I had done that, I think this number would have been much higher.

Final Thoughts: How To Save Money For Travel

By making some small lifestyle changes, it’s possible to save quite a bit of money for your travel goals, even if you’re not earning a massive salary.

Remember that you don’t need to cut out all your favorite things. If you are in love with your gym and it makes you happy, keep it. If the thought of coupon clipping makes you roll your eyes, don’t bother with it.

Pick a few things that you can do right away and start with that. See how it goes for a month or two, then assess if there are other things you can change too.

I bet that once you see the number rising in your travel fund, the changes will feel less like sacrifices and more like exciting steps toward your dream.

More Budget Travel Posts

- 12 Ways To Save Money While Traveling

- How I Traveled Europe Without Breaking The Bank

- How To Book Cheap Flights Anywhere Using Skyscanner

- Travel For Free with Workaway

- Travel For Free as a House Sitter

Cover Photo by Katie Harp – Pinterest Manager on Unsplash

This was a terrific article. Now I want to save money just for the thrill of it. Just to see if I can. Then we will talk about travel. If weeks of rice, beans and veggies will give me your energy and vitality, then rice, beans and veggies it is.

Haha!!! I was pleasantly surprised how far rice beans and veggies got me! Especially with some cheese on top… yum! But then again I’ve always liked plain foods so this shouldn’t be out there, haha!

Nic, this article is EPIC! Thank you for posting. I honestly can’t believe I never thought to open a Travel Savings Account. I used VIPkid and Housesitting to save and I also looked for jobs abroad… but I never knew how much money I “saved” because I never took the time to separate it from the normal savings.

Thanks for this super helpful post!!

Thank you so much!! That was really one of the most helpful things! It was so encouraging to see that savings build (even if it was happening slowly) and it definitely helped keep me motivated! Did you do house sitting to save before traveling too? That’s another great idea for people who aren’t ready to go abroad but don’t want to keep paying for an apartment – house sitting locally is a very real possibility! 🙂

This is all super helpful! I always forget about dog walking as a side gig. So many people need dog walkers, even in rural areas!

Recently, I discovered that my local grocery store has a “penny saver” magazine that comes out every Tuesday; therefor, there are sooo many great deals in the store on Wednesday. For me and my boyfriend, I went from spending around $140 a week when I shopped on Saturdays and Sundays to $85 for the two of us! I nearly cut our spending in half! I have been able to save a LOT of money this way. I don’t have a problem with shopping, but going out to eat and buying extra snacks eats my money away. So shopping when there are the deals at my store helped me 😊

This is Awesome!!! That’s an amazing deal 🙂

Have you heard of the app called Libby? It’s a great book app! Audibles and book rentals are available with a library card! I just discovered it and it’s life changing abroad!! 🙂

Thanks for the awesome post, Nic! Love your writing style! I’m in Thailand, come visit!!

Oh that’s so cool! I definitely need to look into that! I love listening to podcasts so I could see myself getting into Audiobooks as well. Thanks for the tip and have so much fun in Thailand! 🙂